Apr. 14, 2025

Corporate value management has been a long-standing topic of discussion, and the importance of managing non-financial value and intangible assets, which account for an increasing share of corporate value*1, is growing, particularly among global enterprises. However, unlike financial value and tangible assets, which are easier to quantify and manage and have a well-established foundation in finance theory, the systematic management of intangible assets remains insufficient. At Hitachi Research Institute, we are conducting research to realize the “ideal intangible asset management.”

An analysis of S&P 500 companies shows that the proportion of intangible assets*2in corporate value has steadily increased, reaching 90% in 2020*3. Additionally, a positive correlation exists between investment in intangible assets and productivity, suggesting that improving intangible asset management contributes to productivity growth. Therefore, for corporate leaders, understanding their company or organization through the lens of four types of intangible assets—particularly non-financial values within the company, such as (1) human capital, (2) customer capital, (3) process capital, and (4) innovation capital—is a crucial first step toward enhancing corporate value (Table 1).

| Definition | KPIs (example) | |

|---|---|---|

| Human capital | Value that belongs to a person (= value that disappears when an employee is out). Ability, knowledge, skill, innovation, etc. to perform work | Engagement rate (%), employee turnover rate (%), average employee length of service, etc. |

| Customer capital | Value beyond human element. Customer databases, interests, information systems, brands, trademarks, etc. | Market share (%), number of customer visits, customer satisfaction, customer lifetime value, number of co-creation partners, number of projects, etc. |

| Process capital | Collective value of formalized know-how within the company. Manuals, best practices, plans on intranet, etc. | Cost of mismanagement ($), general and administrative expenses/manageable assets, IT expenses/number of employees ($), compliance rate (%) |

| Innovation capital | Value of investment activities looking to the future | Development costs/number of employees ($), R&D costs/revenue (%), etc. |

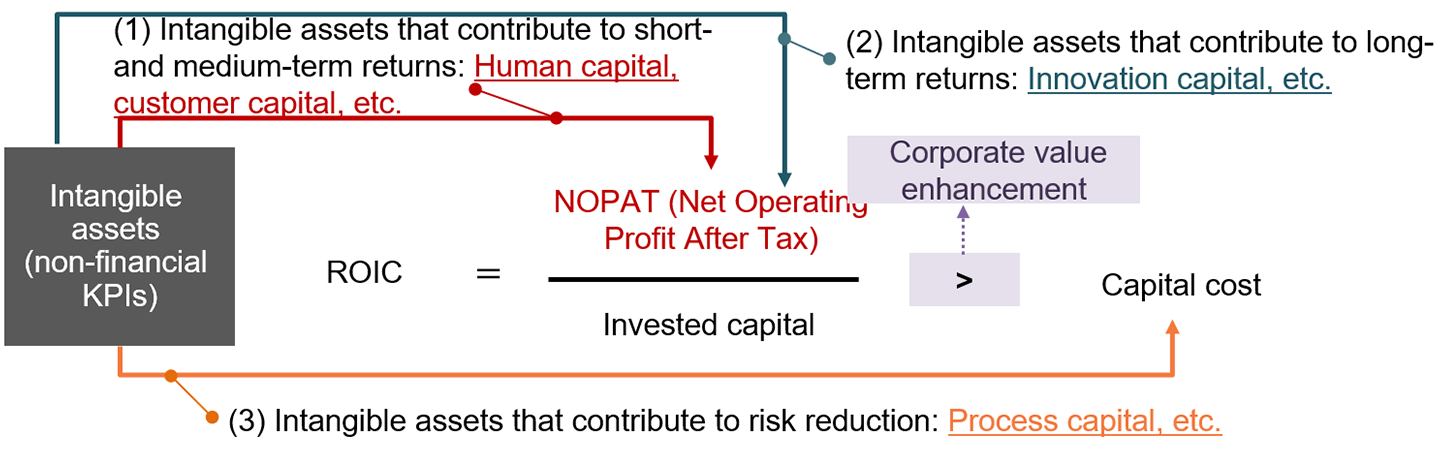

Corporate value expands when the return on invested capital (ROIC) exceeds the cost of capital, i.e., when the ROIC spread is positive. Thus, effective intangible asset management requires visualizing the impact of intangible assets on key financial metrics such as net operating profit after tax (NOPAT) and cost of capital (Figure 1).

Source: Prepared by HRI

Figure 1: Relationship between intangible assets (non-financial KPIs) and corporate value in the ROIC spread formula

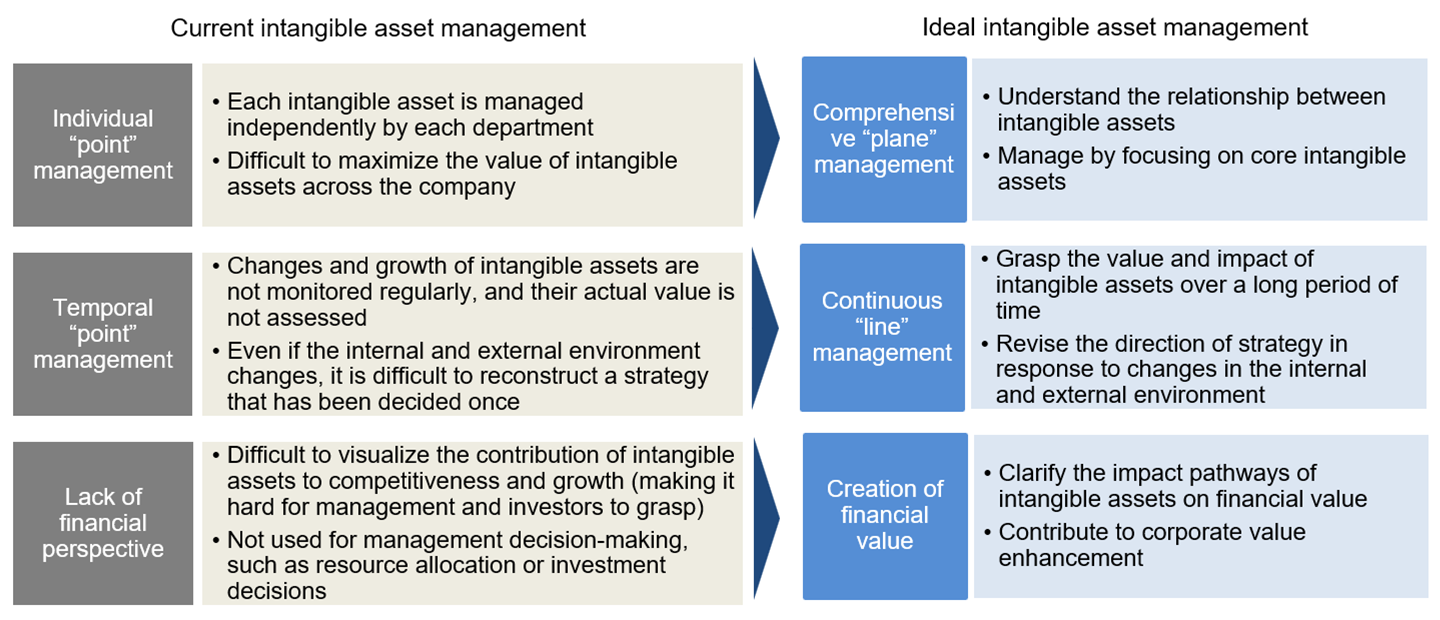

However, current intangible asset management practices face challenges: the relationship between intangible assets and financial value is not adequately visualized and managed, and each category of intangible assets (as shown in Table 1) is managed separately and only at specific points in time. Therefore, it is important to visualize how the expansion of intangible assets contributes to the creation of financial value through comprehensive (“plane”) and continuous (“line”) management of intangible assets (Figure 2).

Source: Prepared by HRI

Figure 2: Comparison of the current and the ideal intangible asset management

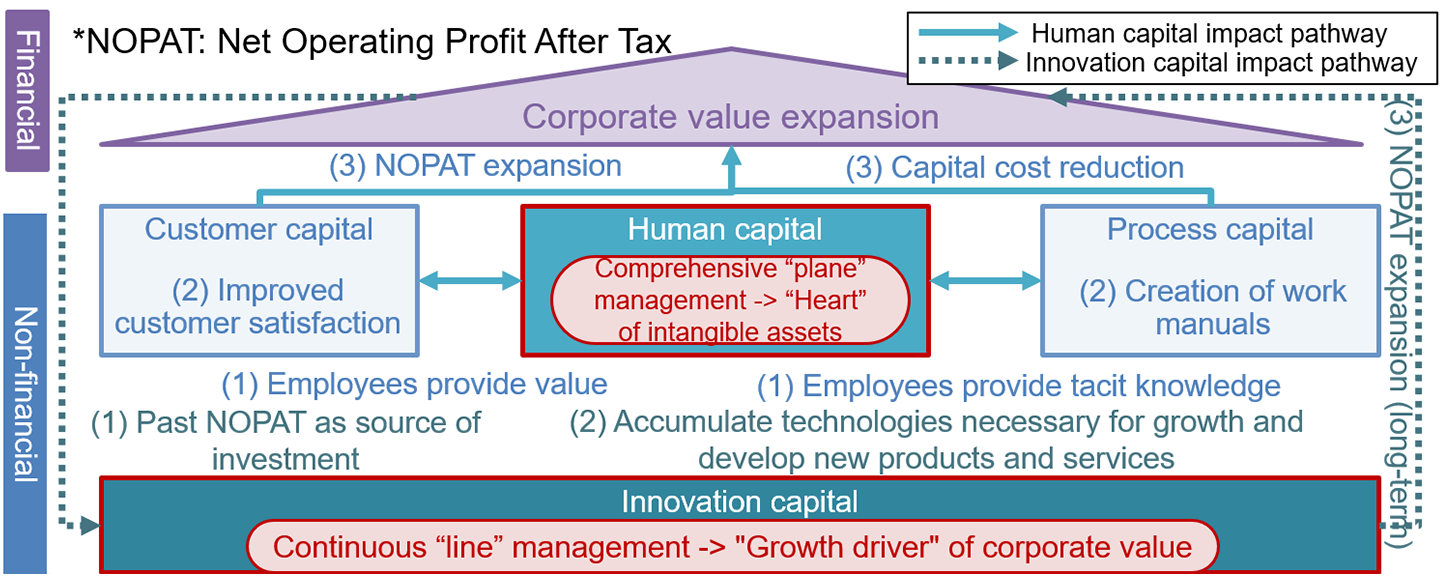

A qualitative analysis*4 conducted by Gartner identified “technology” and “employees” as top business priorities, following “growth.” Additionally, a quantitative analysis*5 by HRI found that while the positive impact of human capital on corporate value gradually weakens over the long term, its correlation with other intangible assets such as customer capital remains strong over time. Moreover, innovation capital strongly influences corporate value only over the long term. These combined qualitative and quantitative insights suggest that human capital and innovation capital are the two most critical intangible assets to manage for driving corporate value expansion (Figure 3).

Source: Prepared by HRI

Figure 3: Impact pathways of human capital and innovation capital on corporate value

The first key intangible asset, human capital, serves as the “heart” of corporate value expansion by influencing other intangible assets and indirectly driving growth. Managing human capital requires a comprehensive “plane” approach. This means overseeing broad impact pathways across multiple intangible assets, such as: “Employees with extensive business knowledge (human capital) contribute their tacit knowledge to the organization, which is then documented into business manuals (process capital). This not only reduces long-term labor costs but also mitigates business-disruption risks by avoiding the dependence of business knowledge on specific individuals, ultimately lowering capital costs and enhancing corporate value.”

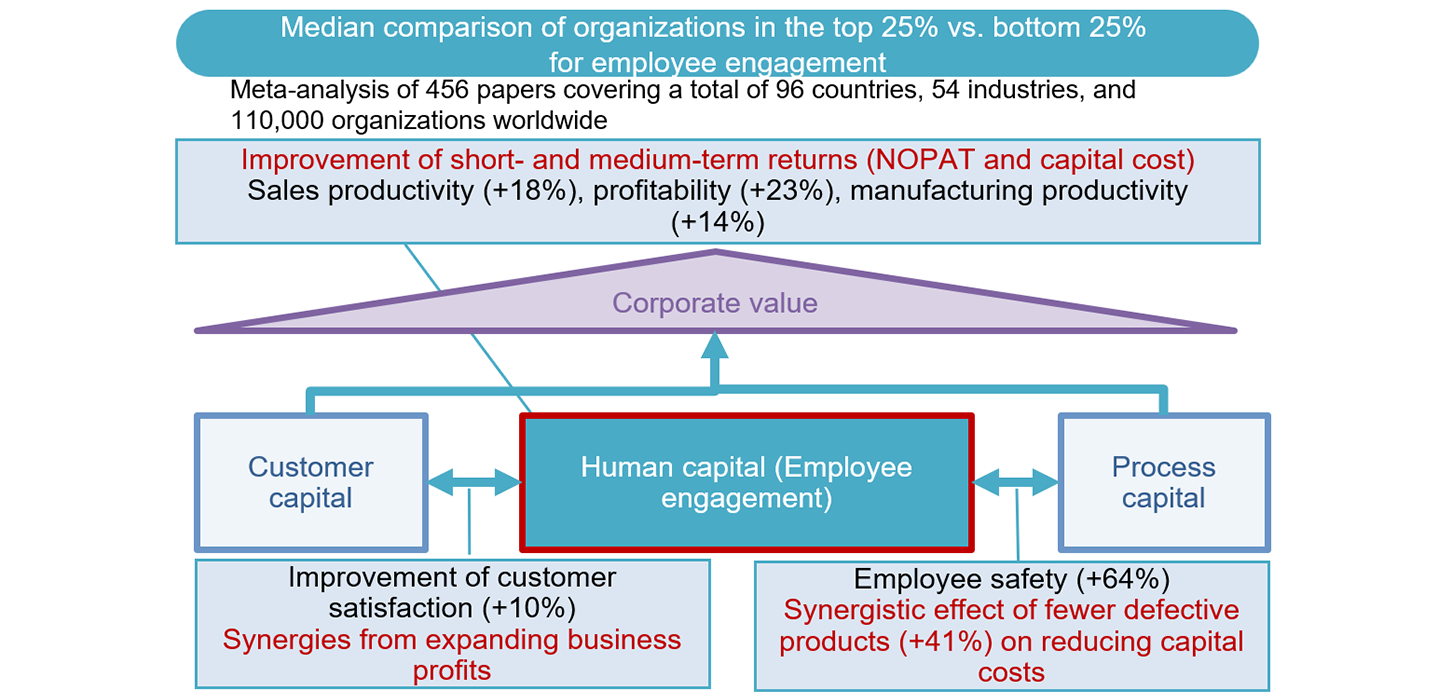

In human capital management, employee engagement (score) is considered a key factor that has a significant impact on corporate value and is relatively easy to measure. In fact, various studies*6 indicate that, for global corporations, employee engagement enhances corporate value through synergies with customer capital and process capital (Figure 4).

Source: Prepared by HRI from Gallup (2020) “The relationship between engagement at work and organizational outcomes”

Figure 4: Impact of comprehensive “plane” management of human capital (employee engagement) on corporate value

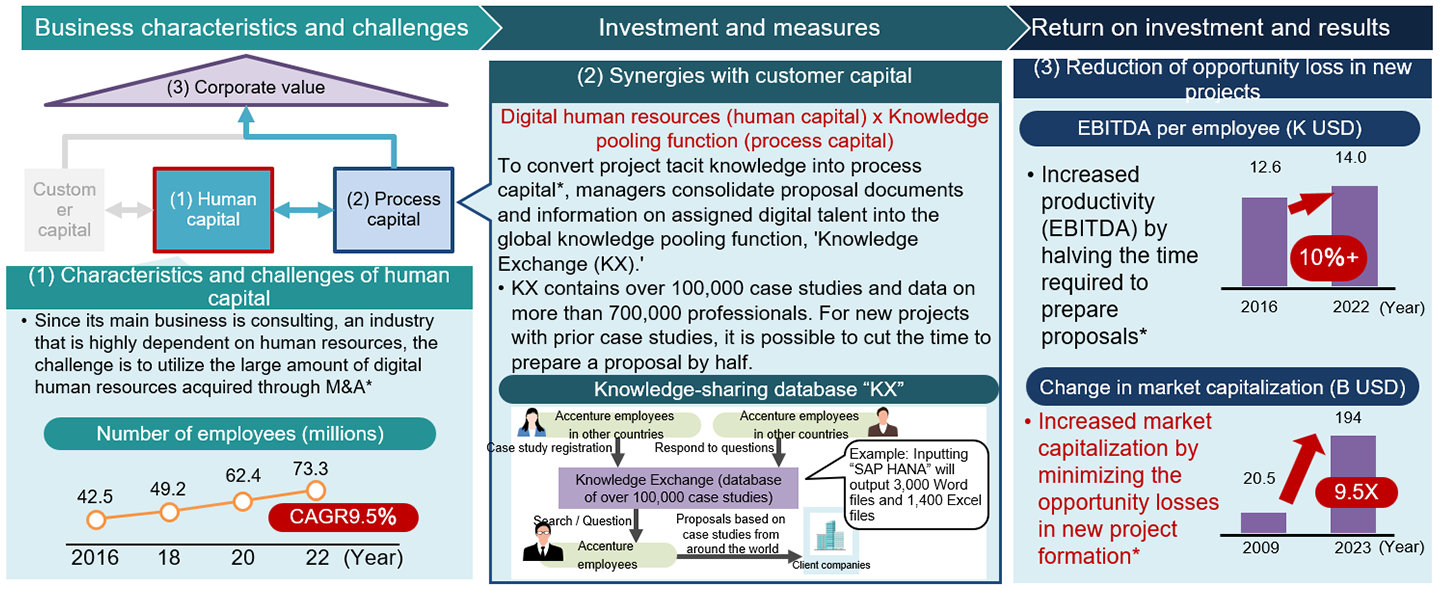

An excellent example of a global leader leveraging comprehensive “plane” human capital management for rapid corporate value growth is Accenture, which utilizes its knowledge-pooling function, “Knowledge Exchange.”

The company has consolidated extensive digital talent acquired through M&A into an immediately deployable workforce, effectively leveraging this human capital. To achieve this, it has pooled knowledge from over 100,000 global case studies and proposal-related insights from more than 700,000 professionals—previously tacit knowledge held by project managers—into the “Knowledge Exchange” function. This “Knowledge Exchange” serves as a form of process capital. As a result, even newly hired digital talent can utilize the pooled knowledge to cut proposal creation time for projects with prior case studies by half, significantly reducing opportunity loss in new project formation. This approach has contributed to long-term reductions in labor costs and the prevention of knowledge silos, leading to greater business stability, a lower risk of knowledge loss due to employee turnover, and a reduction in capital costs. Ultimately, these factors have driven an increase in market capitalization and overall corporate value (Figure 5).

Source: Compiled by HRI based on Nikkei xTECH (2017), “Accenture: Thoroughly sharing cases, people, and software,” and President Online (2008), “Fully-fledged in three years! Accenture's 'networked learning' approach” (*Estimate by HRI).

Figure 5: A case study of HRI’s comprehensive “plane” management of human capital – Accenture's “Knowledge Exchange”

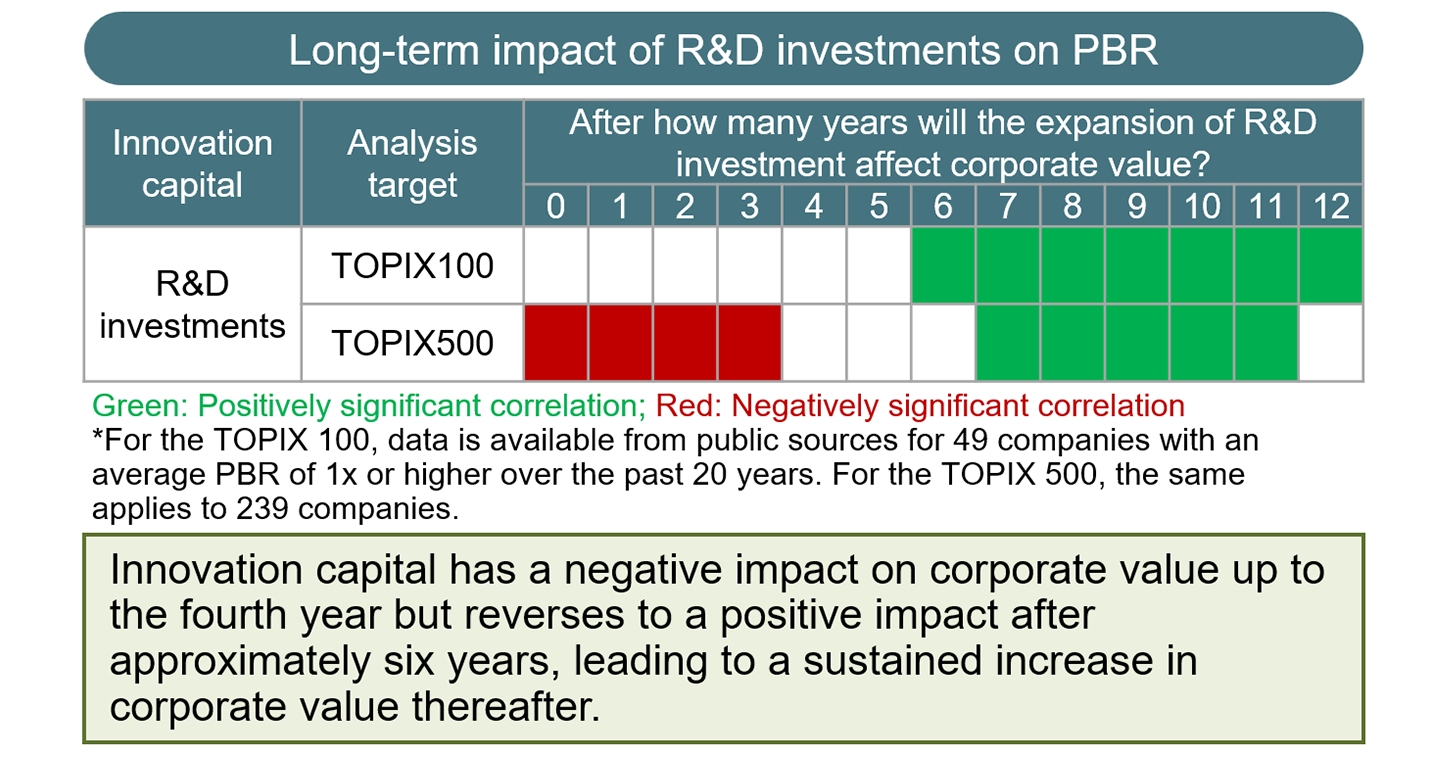

The second key intangible asset, innovation capital, serves as a growth driver for long-term corporate value expansion and requires continuous “line” management, such as through the accumulation of technologies necessary for growth (Figure 3). This accumulation of technology can be understood as “using past business profits (NOPAT, financial capital) as a source for R&D investments, thereby accumulating the technology and knowledge necessary for future growth, i.e., innovation capital.” With this accumulation of technology in mind, “line” management refers to the long-term, sustained impact pathway management that involves leveraging accumulated technology and knowledge to continuously develop and provide new products and services, ultimately generating business profits and expanding corporate value. In innovation capital management, one of the most representative and easily quantifiable indicators directly affecting corporate value is “R&D investment (amount).” A quantitative analysis of publicly traded companies in Japan revealed that the negative impact of R&D investments reverses after about six years, leading to an increase in the price-to-book ratio (PBR) and ultimately enhancing corporate value (Figure 6).

Source: Prepared by HRI based on Yanagi and Sugimori (2021) “CFO Policy” (Chuokeizai-sha, 2020)

Figure 6: The impact of continuous “line” management of innovation capital (R&D investment) on corporate value

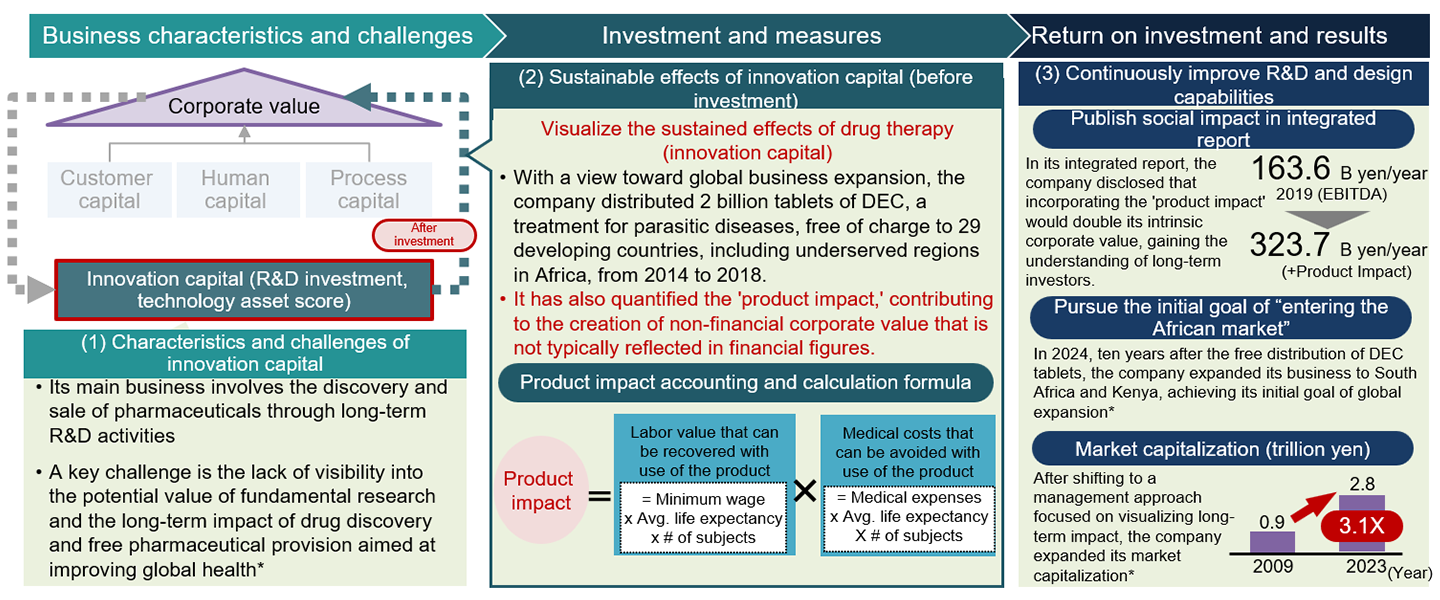

A global industry leader that exemplifies continuous “line” management of intangible assets—and has likely achieved rapid corporate value growth as a result—is Eisai, a major pharmaceutical company. To realize its long-term goal of expanding its global business, Eisai has been distributing highly effective anti-parasitic disease treatment free of charge to developing countries, primarily in Africa, since 2014. The company applies “Product Impact Accounting” to quantify the treatment’s effectiveness (innovation capital) and discloses this information annually in its integrated report (Value Creation Report). By publicly sharing the impact of a business strategy that requires several years to generate profit, such as free drug distribution, Eisai has successfully gained “trust” for long-term investors. Through consistent “line” management, the company expanded into South Africa and Kenya in 2024—ten years after initiating the free distribution program. Moving forward, this strategy is expected to contribute to further increases in market capitalization and corporate value (Figure 7).

Source: Prepared by HRI based on Eisai (2019-23) “Value Creation Report” and other public documents (*Estimate by HRI).

Figure 7: A case study of HRI’s continuous “line” management of innovation capital – Eisai's “Product Impact Accounting”

Hitachi Research Institute will continue to conduct research on the “ideal intangible asset management” to determine what measures and investments leading companies in intangible asset management are taking to bring about synergies and sustainable effects between intangible assets, thereby contributing to the expansion of corporate value.

Ippei Nishida

Senior Researcher, Financial Strategy and Society Research Group, 1st Research Department

Work History: Japanese securities company, the World Bank, and Hitachi, Ltd. (Hitachi Research Institute)

Recent research interests: Finance, FinTech, and Non-financial value.

Author’s Introduction

Ippei Nishida

Senior Researcher,

Financial Strategy and Society Research Group,

1st Research Department

We provide you with the latest information on HRI‘s periodicals, such as our journal and economic forecasts, as well as reports, interviews, columns, and other information based on our research activities.

Hitachi Research Institute welcomes questions, consultations, and inquiries related to articles published in the "Hitachi Souken" Journal through our contact form.